The Effective Annual Rate (EAR) is a critical concept in finance, serving as a standardized measure for assessing investment returns and borrowing costs. Aaryaeditz Org provides a comprehensive explanation of the EAR formula, emphasizing its role in evaluating financial products. Understanding how compounding affects returns is essential for making informed investment decisions. Yet, many overlook the nuances involved in calculating EAR. The implications of these calculations can significantly influence financial strategies.

Understanding the Effective Annual Rate (EAR)

The Effective Annual Rate (EAR) serves as a critical metric for evaluating the true return on an investment or the actual cost of borrowing over a year.

It enables investors and borrowers to conduct an impact assessment, facilitating informed rate comparisons.

The EAR Formula Explained

Understanding the Effective Annual Rate (EAR) is only the beginning; applying the EAR formula is vital for accurate financial analysis.

This formula incorporates the effects of compound interest, enabling individuals to evaluate investment opportunities more effectively.

Importance of EAR in Investment Decisions

Effective Annual Rate (EAR) plays a crucial role in investment decisions by providing a standardized measure of return that accounts for the effects of compounding.

This metric facilitates informed choices regarding investment growth, allowing investors to compare various opportunities effectively.

Furthermore, EAR serves as a valuable tool in risk assessment, helping investors understand potential returns relative to their risk tolerance and objectives.

Practical Examples of EAR Calculation

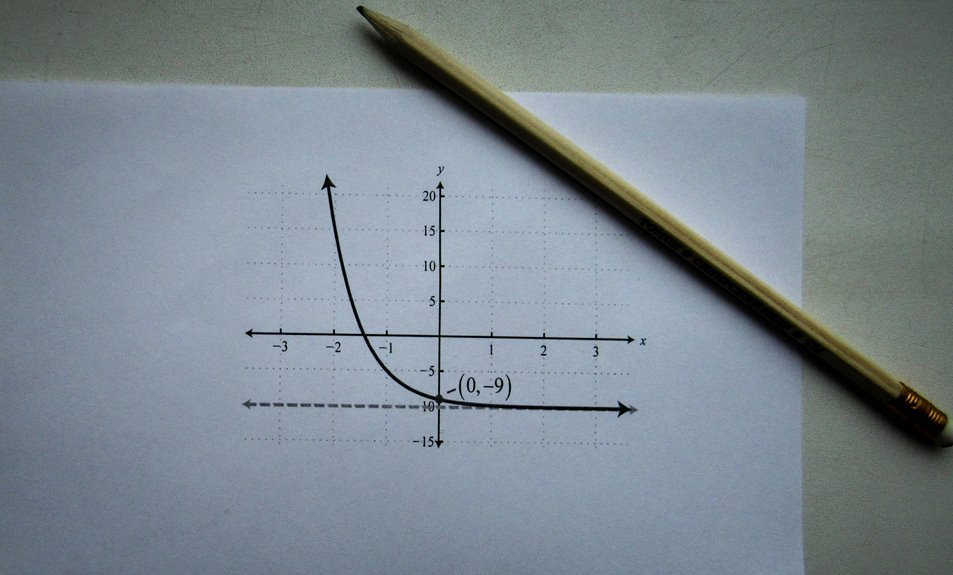

How can one accurately calculate the Effective Annual Rate (EAR) to assess investment returns?

In real-life scenarios, individuals can compare different investment options using the EAR formula, enabling financial comparisons that reveal which choice offers superior returns.

For instance, analyzing a savings account versus a certificate of deposit demonstrates how varying compounding frequencies impact overall earnings, showcasing the significance of understanding EAR in financial decision-making.

Conclusion

In summary, the Effective Annual Rate (EAR) serves as a pivotal tool in the financial landscape, juxtaposing the simplicity of nominal interest rates against the intricate realities of compounding effects. By elucidating the true cost of borrowing and the potential returns on investment, the EAR empowers individuals to make informed financial decisions. This analytical framework not only enhances clarity in comparisons but also underscores the importance of understanding underlying mechanisms in optimizing financial outcomes.