The Fixed Cost Formula serves as a critical tool for businesses in evaluating their financial stability. It encompasses recurring expenses such as rent, salaries, and insurance, which remain constant regardless of production levels. For instance, a company with a monthly rent of $2,000, salaries of $5,000, and insurance costs of $500 would calculate total fixed costs at $7,500. Understanding this formula is crucial for effective financial planning and decision-making. However, the implications of these figures extend beyond mere calculations.

Understanding Fixed Costs

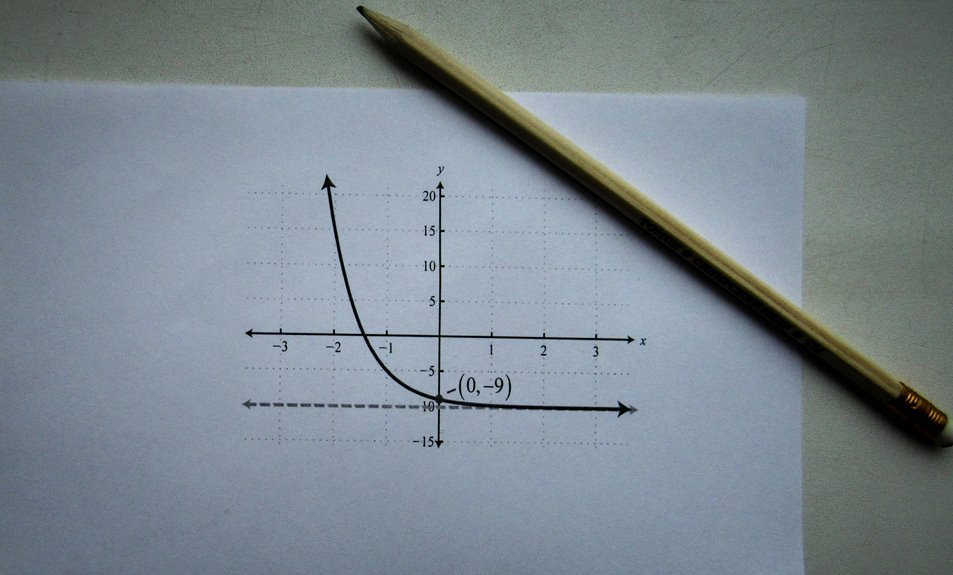

Fixed costs represent a crucial component of a company’s overall financial structure, serving as expenses that remain constant regardless of production levels or sales volume.

Understanding fixed costs is vital for analyzing cost behavior, as they influence a firm’s break-even point and overall profitability.

The Fixed Cost Formula Explained

Understanding the fixed cost formula is essential for businesses aiming to assess their financial health accurately. Fixed costs remain constant regardless of production volume, influencing cost allocation decisions.

Practical Example of Calculating Fixed Costs

While many businesses grapple with variable costs, accurately calculating fixed costs is equally crucial for financial stability.

A practical example involves a company with monthly rent of $2,000, salaries totaling $5,000, and insurance costs of $500. This leads to a fixed cost of $7,500.

Employing effective cost analysis and budgeting strategies ensures that companies maintain a clear understanding of their financial obligations and operational sustainability.

Importance of Fixed Costs in Financial Planning

Accurate calculation and management of fixed costs play a vital role in effective financial planning for businesses.

By incorporating fixed costs into budget management strategies, companies can ensure sustainable operations and informed decision-making.

Moreover, precise expense tracking allows for the identification of potential financial pitfalls, enabling proactive adjustments.

Ultimately, understanding fixed costs empowers businesses to maintain financial freedom while optimizing resource allocation.

Conclusion

In conclusion, the fixed cost formula serves as a critical tool for businesses, juxtaposing the stability of predictable expenses against the volatility of fluctuating revenues. By meticulously calculating fixed costs, organizations can navigate financial uncertainties while simultaneously identifying opportunities for growth. This analytical approach not only enhances budgeting accuracy but also empowers strategic decision-making, ultimately fostering resilience in an ever-changing economic landscape. Thus, understanding and managing fixed costs is paramount for long-term sustainability and profitability.