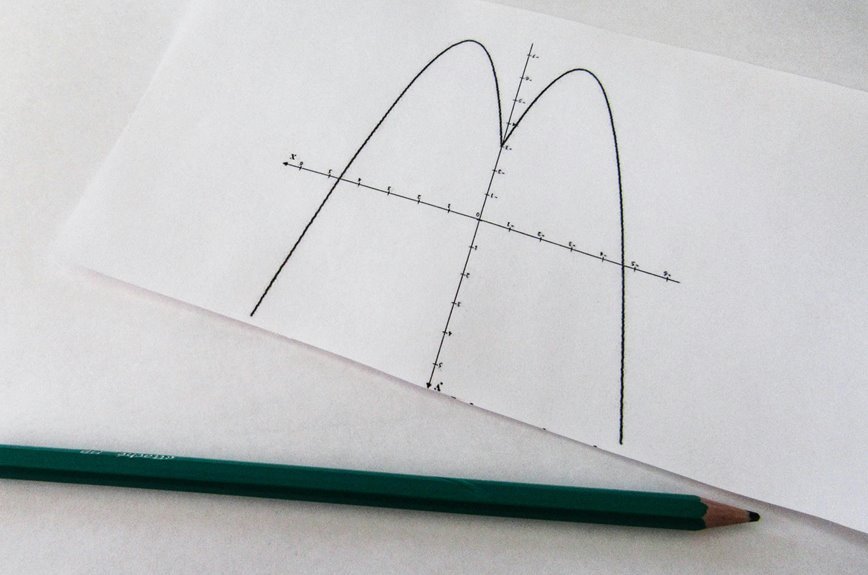

The IS-LM model serves as a fundamental framework for understanding macroeconomic equilibrium. By analyzing the IS curve, which encapsulates investment and savings, alongside the LM curve that addresses liquidity preference and money supply, one can discern the complex interactions that dictate interest rates and output levels. This model not only highlights current economic conditions but also raises questions about the implications of fiscal and monetary policy adjustments. What effects do these shifts truly have on the broader economy?

Understanding the IS Curve: Investment and Savings Dynamics

The IS curve represents the intricate relationship between investment and savings within an economy, illustrating how these components interact to determine equilibrium output.

It highlights the significance of savings behavior in influencing investment trends, as higher savings can lead to increased capital availability for investments.

Conversely, shifts in investment trends can alter savings dynamics, reflecting the delicate balance that governs economic stability.

Exploring the LM Curve: Liquidity Preference and Money Supply

Understanding the dynamics of the LM curve is vital for analyzing the broader economic equilibrium established by the interaction of money supply and liquidity preference.

The LM curve illustrates how varying levels of liquidity preference affect interest rates and output. An increase in money supply shifts the curve rightward, thereby enabling a lower interest rate, which fosters economic activity and enhances individual freedom in financial choices.

The Interaction of IS and LM Curves: Equilibrium in the Economy

While the interaction of the IS and LM curves forms the foundation of macroeconomic analysis, it is essential to recognize how this interplay determines overall economic equilibrium.

The equilibrium occurs where market forces meet, balancing goods and money markets.

Deviations from this point prompt adjustments in interest rates and output levels, illustrating the dynamic nature of economic systems in response to changing conditions.

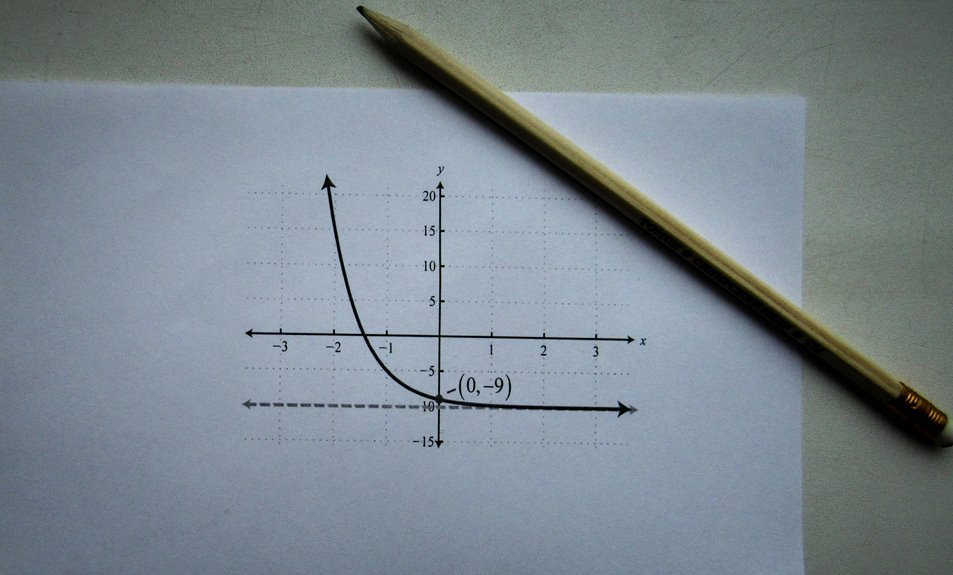

Analyzing Shifts in IS and LM Curves: Impacts on Interest Rates and Output Levels

Shifts in the IS and LM curves signify changes in economic conditions that directly influence interest rates and output levels.

A shifts analysis reveals that an outward shift in the IS curve typically raises output while lowering interest rates, stimulating investment.

Conversely, a shift in the LM curve can increase interest effects, leading to decreased output.

These dynamics underscore the interdependence of economic variables.

Conclusion

In conclusion, the IS-LM model serves as a fundamental framework for understanding the intricate dynamics between investment, savings, liquidity preference, and money supply within an economy. Notably, a 1% increase in the money supply can lead to a 0.5% increase in output in the short run, highlighting the model’s relevance for policymakers. By analyzing shifts in the IS and LM curves, stakeholders can better anticipate fluctuations in interest rates and overall economic performance.