A slush fund is a financial reserve often used for discretionary spending, lacking strict regulatory oversight. Its origins can be traced to various industries, particularly in political contexts. While these funds can support innovative initiatives, they also raise significant ethical concerns regarding transparency and potential misuse. The ongoing debate about their legitimacy prompts a closer examination of how organizations manage such resources and the implications for ethical governance. What guidelines might ensure accountability in their use?

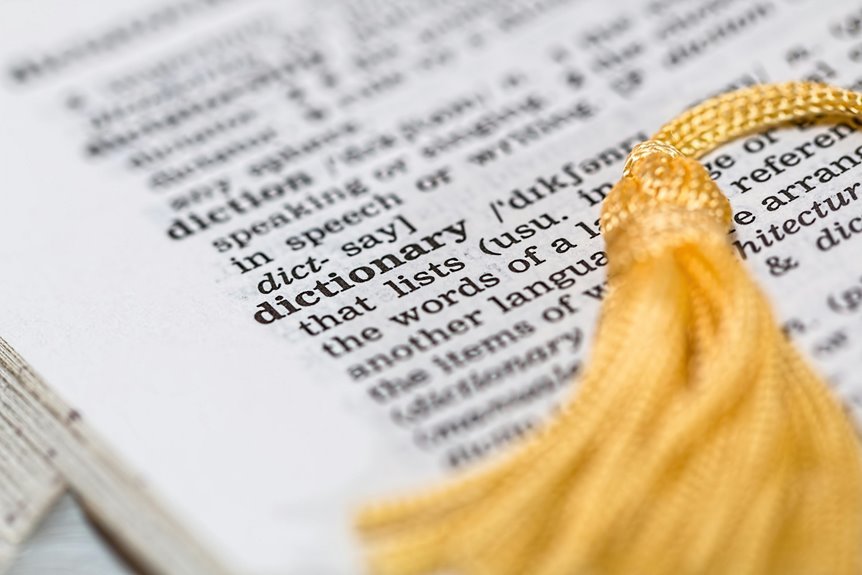

Understanding the Definition of a Slush Fund

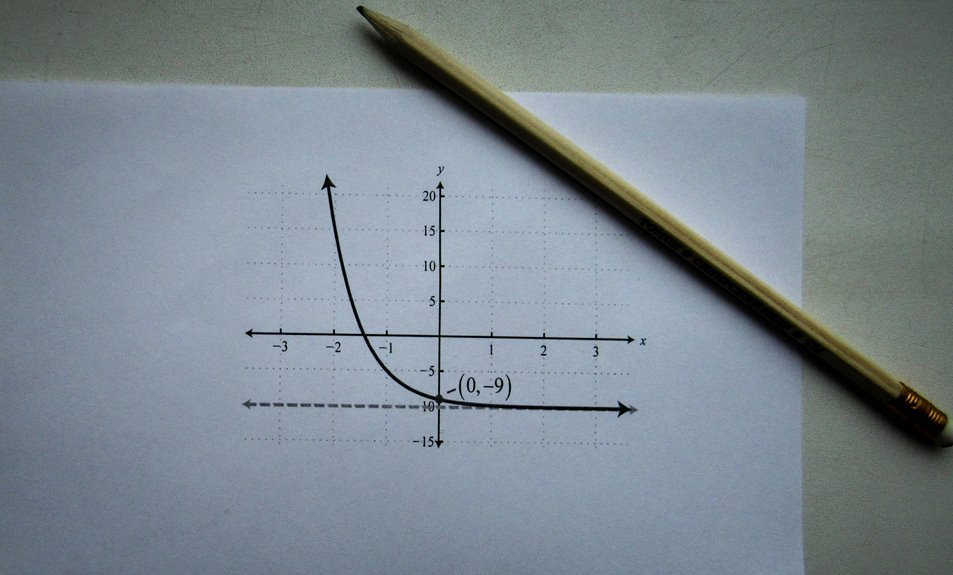

A slush fund, often characterized by its ambiguous origins and intended uses, represents a pool of money set aside for unregulated or discretionary spending.

Within financial terminology, its definition often raises ethical questions regarding transparency and accountability.

Typically utilized by organizations or individuals for purposes outside standard budget allocations, slush funds can facilitate flexibility, albeit at the potential cost of oversight and scrutiny.

Historical Context and Origins of Slush Funds

The concept of slush funds has roots that trace back to various historical contexts, particularly in political and business spheres.

Their political origins often involve covert financial arrangements used to influence decisions or evade regulations, leading to notable financial scandals.

These funds, shrouded in secrecy, highlight the tension between financial maneuvering and ethical standards, reflecting a persistent issue in governance and commerce.

Legitimate Uses of Slush Funds in Business

While often associated with unethical practices, slush funds can serve legitimate purposes in business, particularly in fostering innovation and facilitating agile decision-making.

They can be utilized for employee incentives, motivating staff to exceed performance metrics.

Additionally, slush funds can provide essential project funding for initiatives that require swift financial support, enabling companies to adapt quickly to market changes and capitalize on emerging opportunities.

Ethical Implications and Controversies Surrounding Slush Funds

What ethical considerations arise when businesses utilize slush funds?

Such practices often present ethical dilemmas, as they can undermine financial transparency and accountability.

The secretive nature of slush funds raises concerns about potential misuse for bribery or unethical transactions, ultimately eroding trust among stakeholders.

Consequently, organizations must weigh the benefits against the moral implications of utilizing these opaque financial tools.

Conclusion

In the grand theater of finance, slush funds take center stage, dazzling with their promise of flexibility while cloaked in the shadows of ethical ambiguity. They dance between innovation and impropriety, inviting both creativity and corruption to the party. As organizations juggle the allure of unregulated spending, the audience—taxpayers, stakeholders, and watchdogs—watches with bated breath, pondering whether this financial masquerade will lead to a standing ovation or a scandalous exit. Balance, it seems, is the ultimate act.