The full form of PAN, or Permanent Account Number, serves as a critical identifier for taxpayers in India. Issued by the Income Tax Department, it links financial activities to individuals and entities, promoting compliance with tax regulations. Understanding its significance in taxation and financial transactions is essential for effective financial management. However, many individuals remain unaware of the procedures for applying for a PAN and its broader implications in their financial lives.

Understanding the Full Form of PAN

The Permanent Account Number (PAN) serves as a crucial identifier for individuals and entities in India, primarily in relation to tax obligations.

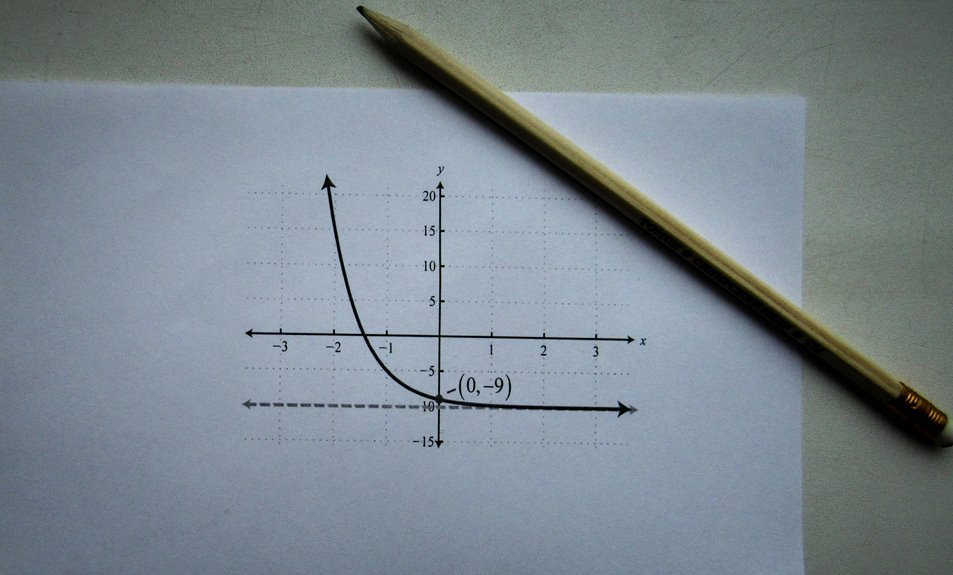

Its significance lies in facilitating seamless PAN usage for various financial transactions, including applying for loans and filing income tax returns.

The PAN enhances transparency and accountability, enabling individuals to efficiently manage their finances while ensuring compliance with regulatory requirements.

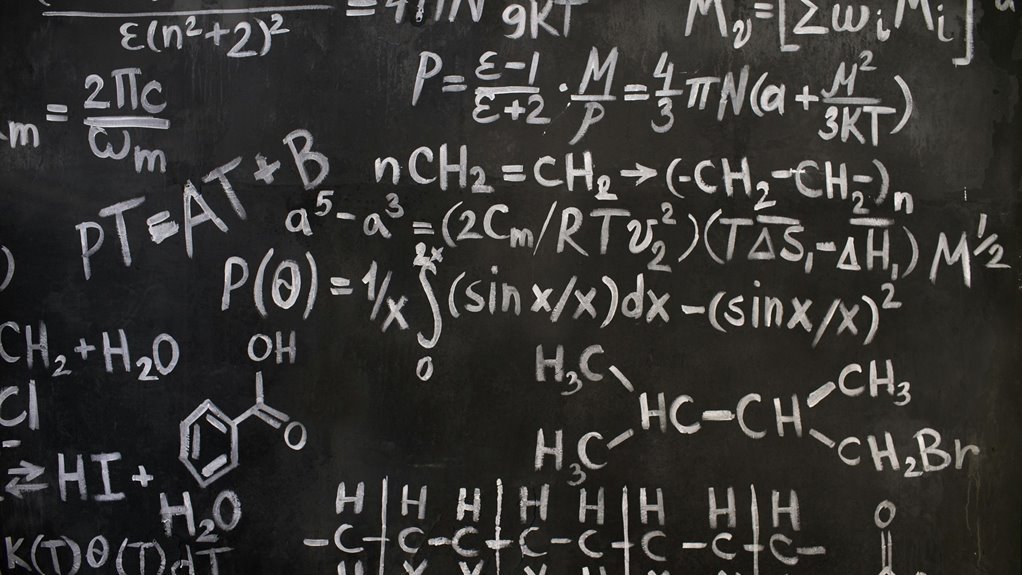

Importance of PAN in Taxation

PAN plays a vital role in the Indian taxation system by serving as a unique identifier for taxpayers.

It ensures tax compliance by linking financial transactions to individuals and entities, thereby facilitating accurate income declaration.

This centralization helps the government monitor tax obligations, reduce tax evasion, and streamline the assessment process, ultimately promoting a fair and efficient taxation framework for all citizens.

How to Apply for a PAN

Applying for a PAN involves a straightforward process that can be completed online or offline.

For online registration, applicants must visit the official website, fill out the application form, and submit required documents.

The offline method requires submitting a printed form at designated centers.

Both methods ensure a smooth application process, allowing individuals to efficiently obtain their PAN while maintaining personal freedom in managing their finances.

Role of PAN in Financial Transactions

While managing personal finances, individuals often overlook the significance of a Permanent Account Number (PAN) in financial transactions.

The PAN utility extends beyond tax identification; it facilitates seamless financial tracking, enabling individuals to monitor income, investments, and expenditures.

Conclusion

In essence, the Permanent Account Number (PAN) serves as a golden key to the intricate world of taxation and financial transactions in India. By facilitating transparency and compliance, it quietly champions the cause of responsible financial stewardship. Obtaining a PAN not only alleviates the burdens of tax evasion but also opens doors to a more organized financial future. Embracing this essential identifier heralds a commitment to clarity in personal finance, ushering individuals into a realm of fiscal responsibility.